Fund Portyra:

Fund Portyra Finds High Probability Trades in Seconds

Sign up now

Sign up now

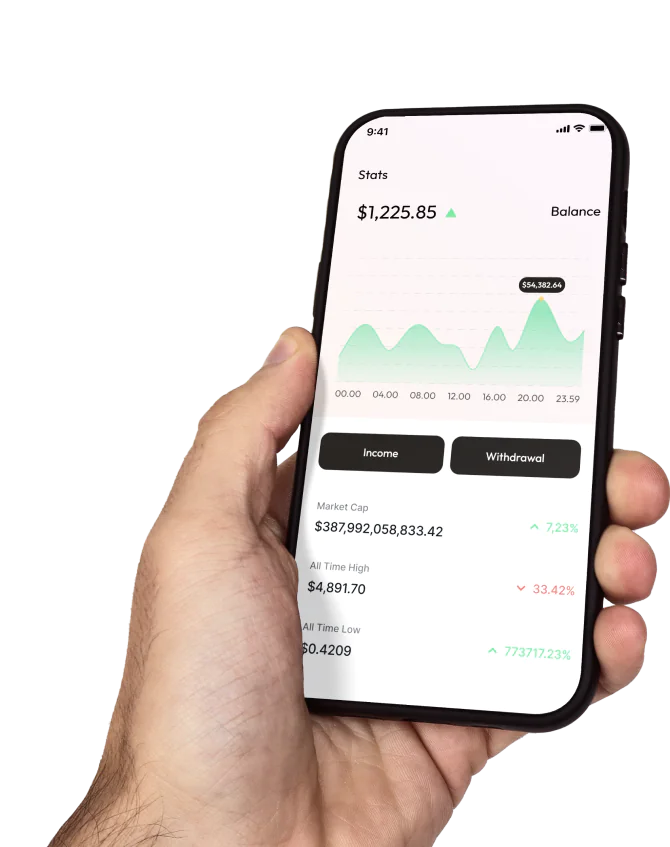

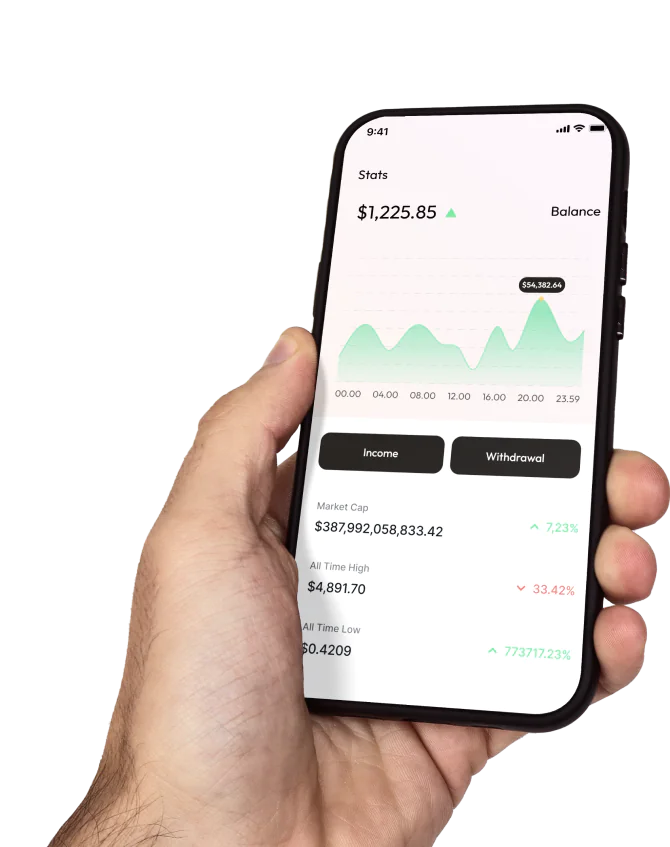

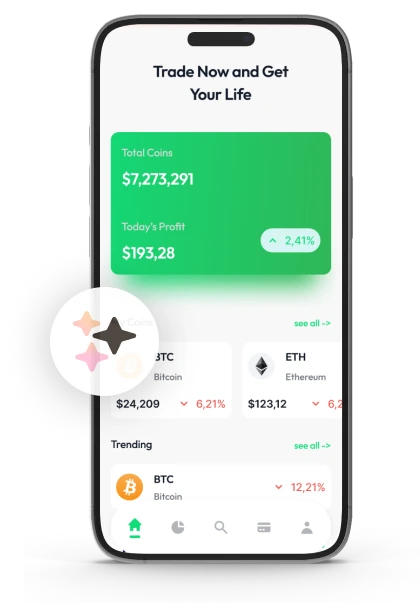

Fund Portyra supports traders of every skill level by transforming raw crypto data into clear, AI powered insights. Its clean dashboard removes clutter and helps users understand trends faster, so decisions feel simpler and more confident. This clarity reduces mental strain, steadies emotions, and keeps traders disciplined even when markets become unpredictable.

Real time analysis lets Fund Portyra spot momentum shifts, reversals, and major trend changes as they happen. Signals arrive early, helping traders stay composed during sudden volatility and react quickly rather than hesitating. This speed matters when markets move fast and timing determines whether a trade succeeds or fails.

Fund Portyra also offers copy trading so users can mirror experienced traders while maintaining control over risk and execution. AI explanations break down why each trade was taken, connecting results to strategy logic. Over time, this learning approach builds confidence, sharpens decision making, and improves long term trading performance.

Fund Portyra uses adaptive AI to monitor global market activity and detect trend shifts early. Its models evolve as new data flows in, keeping predictions accurate even when conditions change rapidly. Built in security safeguards protect user data and ensure consistent performance, making the platform dependable for long term trading.

Fund Portyra turns complex market information into clear, actionable signals. By simplifying the data, it reduces confusion and helps traders maintain a structured approach. This improved clarity supports disciplined decision making, even during rapid price swings when emotions can disrupt consistency.

With live market scanning and historical context, Fund Portyra flags meaningful changes before they become obvious. It filters out noise so traders can focus on high confidence setups. This helps improve timing, keeps discipline strong, and enables rational execution when volatility spikes.

Copy trading in Fund Portyra lets users follow skilled traders while staying in control. Every trade includes AI explanations so users understand the reasoning behind it before copying. Over time, this builds confidence, sharpens judgment, and supports sustainable improvement in trading skills.

Fund Portyra puts control back in the trader’s hands by delivering market intelligence while keeping all trade decisions user controlled. Every signal is optional, ensuring transparency and independence. Strong security protects stored data, giving traders confidence to use AI insights without fearing privacy breaches or unauthorized access.

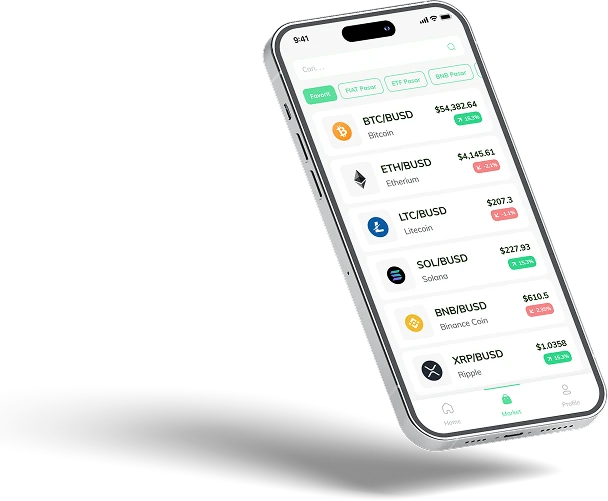

A unified dashboard in Fund Portyra brings all research tools into one place, eliminating the need to switch platforms. Market data is simplified into structured signals, making asset comparisons and strategy evaluation easier. This organized setup reduces confusion, speeds up analysis, and helps traders make decisions more logically.

Live AI monitoring in Fund Portyra tracks market activity continuously and highlights major shifts immediately. Alerts help traders improve entry and exit timing while staying aligned with changing conditions. By focusing on high impact signals and filtering noise, the platform supports disciplined execution even during fast moving markets.

Fund Portyra improves trading discipline by transforming complex market data into clear, actionable insights. Advanced AI processes broad data streams to identify strong trend signals and potential opportunities. With a clean, structured interface, the platform supports consistent performance and calm confidence even when markets swing violently.

Real time adaptive AI lets Fund Portyra update its analysis as market conditions change. Incoming data is filtered into relevant, context based insights rather than overwhelming volume. This reduces cognitive overload and helps traders stay composed, ensuring they receive accurate guidance during high pressure decision moments.

By combining historical patterns with live price action, Fund Portyra keeps market structure assessments current. Its machine learning models evolve with new data, aligning insights with emerging trends. This adaptive intelligence supports strategy adjustments and helps traders react effectively when momentum shifts unexpectedly.

Continuous market monitoring is core to Fund Portyra. Real time processing responds instantly to price changes, keeping users informed without delay. This ongoing awareness helps traders recognize shifts early, stay ahead of the market, and move confidently when new opportunities start to form.

Fund Portyra also offers responsive support to ensure smooth operation. From feature guidance to technical assistance, expert help keeps the platform running reliably. This support allows traders to focus on strategy and execution, while operational details are handled efficiently in the background.

The analytics engine behind Fund Portyra is built for real time market responsiveness. It tracks price action, volatility shifts, and trend indicators continuously, updating its models as conditions change. This dynamic approach delivers reliable insights that help traders time entries better, adapt strategies faster, and stay aligned with market direction across all skill levels.

Fund Portyra reduces the burden of constant monitoring by filtering the noise and highlighting high probability opportunities. Alerts are supported by educational explanations so users understand the “why” behind each signal. This keeps learning consistent while ensuring trade execution remains fully controlled by the trader.

Trust, clarity, and performance are the foundation of Fund Portyra. Robust encryption and strict access controls protect user data, while clear guidance and learning resources support steady improvement. This combination of security and structured insight helps traders maintain discipline and confidence in fast moving crypto markets.

Long term trading success starts with disciplined analysis, and Fund Portyra provides a structured framework that supports every trading style. Whether you prefer quick momentum plays or slower directional setups, the platform helps users read price structure, review historical behavior, and align trades with their goals. This consistency remains strong even when markets shift unexpectedly.

Using AI powered analytics, Fund Portyra constantly processes market data to uncover actionable opportunities. Real time signals reveal changing market dynamics, helping traders adapt strategies without losing focus. This evolving system supports continuous learning while keeping every approach aligned with trading objectives and disciplined execution.

Markets include traders with different time horizons, from quick intraday players to those following longer trend cycles. Short term methods focus on fast swings, while long term approaches track sustained direction. Fund Portyra uses AI to assess both styles, helping traders align strategies with goals and current market conditions for better consistency.

Liquidity impacts price movement and trade execution. Deep liquidity tends to smooth price action, while low liquidity can create sudden volatility. Fund Portyra monitors liquidity shifts in real time, giving traders a clearer sense of market stability so they can adjust timing and strategy as depth changes.

Execution quality depends on balancing profit potential with risk. Fund Portyra highlights important price zones using AI to support structured risk planning. These insights help traders make disciplined entry and exit decisions, manage exposure, and stay in control without relying on automated execution.

Fund Portyra turns complex market data into clear, usable insight. Real time analysis identifies meaningful trend changes as they happen, keeping traders informed and ready. This clarity helps users refine strategy, stay disciplined, and make confident decisions when conditions shift or trends reverse unexpectedly.

Fund Portyra upgrades technical analysis by merging all key indicators into one cohesive system. Traders no longer juggle multiple charts and tools; instead they view trend direction, momentum shifts, and reversal signals in one place. This unified layout increases clarity, helping users make consistent decisions through structured and organized technical data.

Fibonacci retracement highlights likely reaction zones where price often pauses or reverses. The Stochastic Oscillator measures momentum strength and shows potential exhaustion, while MACD confirms trend direction and momentum changes. Together, these indicators form a complete view of market behavior, helping traders monitor shifts more accurately.

AI powered signal ranking in Fund Portyra filters out noise by emphasizing the most valuable indicator results. This focused presentation helps traders spot meaningful patterns quickly and refine strategies with confidence. By prioritizing clarity and relevance, the platform ensures users can rely on dependable insights instead of technical overload.

Market moves are shaped by both price action and trader psychology, since emotions often fuel momentum. Sentiment analysis evaluates news, social media, and behavior patterns to measure market mood. Fund Portyra translates these emotional signals into organized insight, helping traders understand how collective psychology influences trend strength and direction.

Fund Portyra uses AI powered sentiment tracking to monitor shifts in investor emotion across multiple sources. Early signs of growing confidence or rising fear can signal upcoming volatility changes. Since sentiment can either support trend continuation or indicate a reversal, this intelligence helps traders adjust positions with better timing.

When sentiment indicators are paired with technical analysis, Fund Portyra offers a more complete view of market conditions. Watching emotional trends alongside price action helps traders stay aligned with dominant forces. This combined approach supports disciplined trading by blending psychological context with clear technical signals.

Economic data like inflation reports, employment figures, and central bank decisions can trigger major crypto moves. Fund Portyra uses AI macro intelligence to analyze these events and explain their likely impact on digital asset demand and volatility. This helps traders interpret market shifts with clearer context and more strategic insight.

Regulatory announcements and policy changes also shape market direction over time. Fund Portyra reviews past market responses to similar updates, revealing patterns that support smarter long term planning. By organizing these insights into a clear format, the platform helps traders evaluate risk and opportunity with more confidence.

Trend strength and news reactions depend on timing, and Fund Portyra helps traders stay ahead by blending historical analysis with live market monitoring. AI models compare past price behavior with current conditions to anticipate reversals and volatility spikes. This proactive system improves timing accuracy and supports better decisions in fast moving markets.

Fund Portyra evaluates recurring cycles, volatility changes, and breakout conditions to provide ongoing context for price action. These signals help traders track market flow, identify transitions early, and adjust strategies as momentum shifts. The platform’s insights encourage disciplined execution and more precise strategy refinement when conditions change.

Long term trading stability comes from diversification and controlled exposure. Spreading risk across multiple assets can soften the impact of sudden market swings and strengthen portfolio resilience. Fund Portyra uses AI powered historical analysis to show how different allocation strategies performed under varied conditions, helping traders plan with structure and confidence.

By prioritizing signal quality, Fund Portyra filters noise and highlights meaningful short term changes. AI insights detect emerging shifts quickly, improving traders’ awareness. This targeted delivery helps users respond efficiently during rapid market moves and high volatility without being overwhelmed by data.

Momentum often builds before it becomes obvious. Fund Portyra analyzes early directional cues to identify where strength is forming. This early detection gives traders clearer entry opportunities, allowing them to act before broader trend confirmation and potential acceleration.

Fund Portyra also uses AI driven volatility tracking to interpret sharp market movements. Instead of raw data, it delivers structured insight into changing conditions. This clarity helps traders stay calm, strategic, and confident even when markets become unstable and unpredictable.

Fund Portyra enhances crypto research by combining advanced AI analysis with professional market experience. It processes large datasets to spot early trend signals and subtle behavior patterns, then converts them into organized, actionable insights. This clear presentation boosts understanding and helps users navigate complex markets with greater confidence.

Fund Portyra is designed for fast response as market conditions shift, updating its analysis while keeping the interface simple. Automated precision is paired with strategic context, enabling real time monitoring of evolving trends. This balanced approach keeps traders informed and helps them make smarter decisions without adding extra complexity.

Fund Portyra uses adaptive AI to continuously analyze large market datasets, identify shifting patterns, and deliver actionable intelligence instantly. Its models update as new information arrives, keeping accuracy high even when market behavior changes. This evolving analysis improves insight into trend development and price dynamics, supporting disciplined research and more confident decisions.

With an intuitive layout, Fund Portyra is accessible to traders at any experience level. It turns complex data into understandable insights without automating trades, so users keep full control. This user friendly approach supports learning, builds confidence, and encourages careful manual execution.

Fund Portyra prioritizes clarity and comprehension over automation. It provides transparent analytics that explain volatility, trend structure, and macro influences. This educational framework helps traders develop strategic thinking while maintaining full control over analysis and trading choices.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |